Georgian economy lost 4 billion GEL last year amid the pandemic. The government predicts, that the loss will reach 8,5 billion GEL between 2020-2021. The loss is reasoned by the stagnancy of the tourism sector, which reflected on the parameters of economic growth. If the pandemic continues, the economy will take several more years to recover.

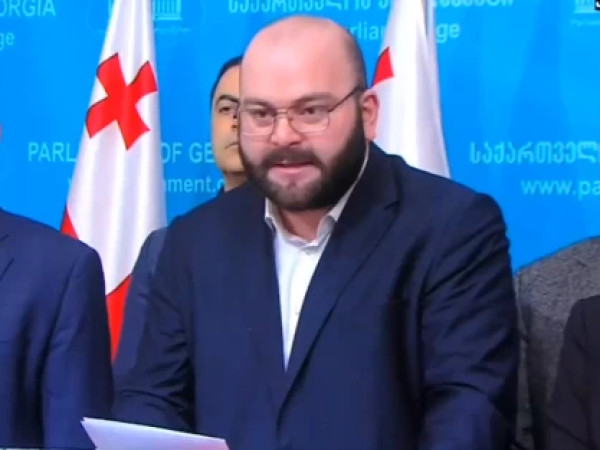

Beka Liluashvili, Former Economic Advisor to the Ex-PM is urging the government to make new decisions to attract investment. He notes, that such an incentive could be tax breaks, which apply equally to both domestic and international investments.

“To me, economic recovery will continue in 2021-2023, this period is necessary for tourism to return to the pre-pandemic level. So we need decisions focused on the encouragement of investments. Other countries encourage investments at the expense of low interest rate policy, however, we do not have such resource, as our economy is highly dollarized and lower interest rates lead to inflationary processes”, Liluashvili declares.

According to the former Economic Advisor, benefit should apply to new investments regardless of the origin (foreign or domestic investment), but it must be considered as a temporary measure.

“Conditionally, we can say, that tax break will apply to anyone who makes investment in 2021-2023. This will create additional incentives to make investments in the country," Liluashvili said.

Former Economic Adviser regards, that the country’s macroeconomic base is precondition for new investments, however, he deeply believes that the country can make fiscal consolidation in order to attract investors, which means abolishment of ineffective tax breaks.

"Many countries started off fiscal consolidation, but it needs a proper calculation. Fiscal consolidation means abolishment of ineffective tax breaks. For example, the government can abolish tax breaks on the imports which applies to low income as well as high income entities. This is wrong and we must make this process fair”, Liluashvili declares.

He notes, that tax breaks should be abolished, but the government must help socially vulnerable people and increase pensions with these funds.

It is not difficult to guess how the new Georgian PM will encourage foreign directs investments in the country amid the political crisis, which negatively affects the country’s image. In Q3, 2020 FDI was 23.6% down amounting to 302.6 million USD. As of 9 months, total volume of the FDI was 719 million USD, which is 24% or 228 million USD less comparing to 2019.