The European Central Bank on Thursday announced a further rate hike of 50 basis points, despite turmoil in banking stocks.

The ECB had signaled for several weeks that it would be raising rates again at its March meeting, as inflation across the 20-member region remains well-above targeted. In February, preliminary data pointed to a headline inflation of 8.5%, well above the central bank’s target of 2%.

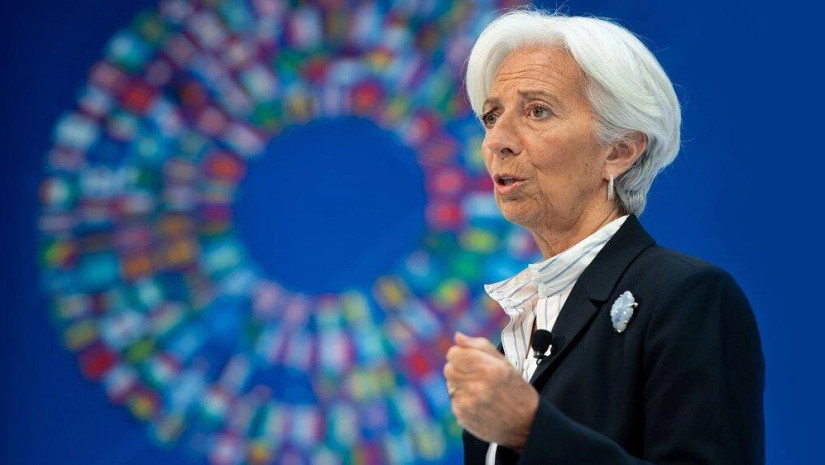

Some market players questioned whether President Christine Lagarde would still go ahead with the move, given recent shocks in the banking sector. Credit Suisse shares tumbled by as much as 30% in Wednesday intraday trade, and the whole banking sector ended Wednesday’s session down by about 7%.

Initial pressures on the banking sector emerged last week, when U.S. authorities deemed Silicon Valley Bank insolvent. The event threw international subsidiaries of the bank into collapse and raised concerns about whether central banks are increasing rates at a very aggressive pace. Goldman Sachs quickly adjusted its rate expectations for the Federal Reserve, due to meet next week — the bank now anticipates a 25 basis point increase, after previously forecasting a 50 basis point hike.

European officials were keen to stress that the situation in Europe is different from the one in the United States. Overall, there is less deposit concentration — SVB was an important lender to the tech and healthcare sectors — deposit flows seem stable, and European banks are well capitalized since the regulatory transformation that followed the global financial crisis.

Equity action on Thursday showed some relief across the banking sector, after Credit Suisse said it will borrow up to $54 billion from the Swiss National Bank, CNBC reports.