The International Monetary Fund on Tuesday cut its growth forecasts for China and the euro area and said overall global growth remained low and uneven despite what it called the "remarkable strength" of the U.S. economy.

The IMF left its forecast for global real GDP growth in 2023 unchanged at 3.0% in its latest World Economic Outlook (WEO), but cut its 2024 forecast by 0.1 percentage point to 2.9% from its July forecast. World output grew 3.5% in 2022.

IMF chief economist Pierre-Olivier Gourinchas told reporters the global economy continued to recover from the COVID-19 pandemic, Russia's invasion of Ukraine and last year's energy crisis, but growth trends were increasingly divergent across the globe, and prospects for medium-term growth were "mediocre."

Gourinchas said the forecasts generally pointed to a soft landing, but the IMF remained concerned about risks related to the real estate crisis in China, volatile commodity prices, geopolitical fragmentation, and a resurgence in inflation.

A fresh unexpected risk emerged in the form of the Israel-Palestinian conflict just as finance officials from 190 countries gathered in Marrakech for the annual meetings of the International Monetary Fund and World Bank, but came after the IMF's quarterly outlook update was locked down on Sept. 26.

Gourinchas told Reuters it was too early to say how the major escalation in the long-running conflict would affect the global economy: "Depending how the situation might unfold, there are many very different scenarios that we have not even yet started to explore, so we can't make any assessment at this point yet."

Stronger growth is being throttled by the lingering impact of the pandemic, Russia's war in Ukraine and increasing fragmentation, along with rising interest rates, extreme weather events and shrinking fiscal support, the IMF said. Total global output in 2023 is slated to be 3.4%, or roughly $3.6 trillion, below pre-pandemic projections.

"The global economy is showing resilience. It's not knocked out by the big shocks it's experienced in the last two or three years, but it's not doing too great either," Gourinchas told Reuters in an interview. "We see a global economy that is limping along and it's not quite sprinting yet."

The medium-term outlook is no better. The IMF is projecting growth of 3.1% in 2028, well below the 4.9% five-year forecast it had on the eve of the global financial crisis in 2008-2009.

"You have uncertainty. You have geoeconomic fragmentation, low productivity growth, and low demographics. You put all these things together and you have a slowdown in medium-term growth," he told Reuters.

NOT QUITE THERE ON INFLATION

Inflation continued to decline around the globe due to a fall in energy prices and to a lesser extent food prices. It is expected to drop to an annual average of 6.9% in 2023, from 8.7% in 2022, and to 5.8% in 2024.

Core inflation, excluding food and energy prices, is coming down more gradually, and should drop to 6.3% in 2023, from 6.4% in 2022, and to 5.3% in 2024, given still-tight labor markets and stickier-than-expected services inflation, the IMF said.

"We're not quite there," Gourinchas said in a separate meeting with reporters, adding the IMF was warning monetary authorities not to ease interest rates too soon.

Labor markets were generally quite buoyant and unemployment rates were at historical lows in most advanced economies, but there was not much evidence of a wage-price spiral that could trigger a second round of price inflation, even with a major strike by U.S. autoworkers in the United States.

"We're not seeing strong signs of an out-of-control sequence of wages chasing prices and prices chasing wages," he said.

The IMF said uncertainty had narrowed considerably since its April forecasts were released, but there were still more downside than upside risks for 2024. The chance of growth falling below 2% - which has only occurred five times since 1970 - was now seen at 15%, compared with 25% in April.

The IMF noted that investment was uniformly lower than before the pandemic, with businesses showing less appetite for expansion and risk-taking amid rising interest rates, withdrawal of fiscal support and stricter lending conditions.

Gourinchas said the fund was advising countries to remain vigilant on monetary policy until inflation was durably coming down toward targets, while urging them to rebuild thin fiscal buffers to address future challenges or shocks.

US GROWTH BEATING PRE-PANDEMIC FORECASTS

The IMF raised its forecast for growth in the United States, the world's largest economy, by 0.3 percentage point to 2.1% for 2023, and by 0.5 percentage point to 1.5% for next year, citing stronger business investment and growing consumption. That makes the U.S. the only major economy to beat pre-pandemic forecasts.

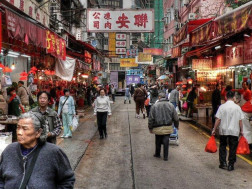

In China, by contrast, GDP was expected to expand 5.0% in 2023 and 4.2% in 2024, reflecting respective downward revisions of 0.2 and 0.3 percentage point, mainly due to the country's real estate crisis and weak external demand.

Gourinchas said "forceful action" was needed in China to clean up the real estate sector and while authorities had taken some steps, more work was needed. "If that doesn't happen, then there is a chance that that problem could fester and become worse," he said.

The IMF also cut its growth estimates for the euro area to 0.7% in 2023 and 1.2% in 2024, down from respective July forecasts of 0.9% and 1.5%.

The UK, which like the euro area has been hit hard by the shock of high energy prices, saw its growth forecast raised by 0.1 percentage point to 0.5% for 2023, but cut by 0.4 percentage point to 0.6% for 2024.

Japan is expected to see growth of 2.0% in 2023, a 0.6 percentage point upward revision, buoyed by pent-up demand, a surge in inbound tourism, its accommodative monetary policy and a rebound in auto exports, the IMF said. It left Japan's 2024 growth outlook unchanged at 1.0%, Reuters reports.