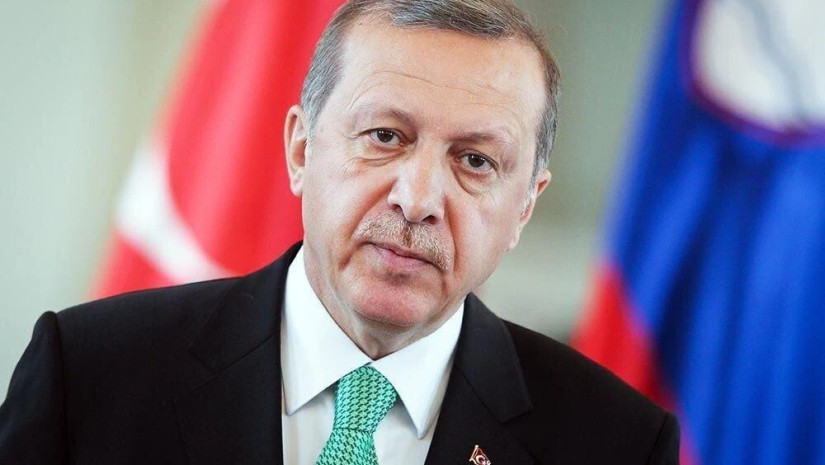

President Recep Tayyip Erdogan repeated his call on the central bank to further lower its key policy rate and invited investors to benefit from cheap loans from public banks.

Erdogan’s opposition to high borrowing costs has been backed by his treasury and finance minister, who said the government’s new economic model rejects the belief that interest rates should be higher than inflation to tame price increases.

The remarks came more than a week after Erdogan said he had advised the central bank to cut its benchmark one-week repo rate at its upcoming meetings and that he expects interest rates to come down to single digits by year-end.

The Central Bank of the Republic of Turkiye (CBRT) surprised markets as it cut its policy rate by 200 basis points to 12% in the last two months. The bank had embarked on a rate-cutting cycle more than a year ago as it lowered its one-week repo rate by 500 basis points to 14%, where it had left it steady in the first seven months of this year.

Addressing a rally in the western province of Balıkesir, Erdoğan said the monetary authority would continue to cut its interest rates every month for as long as he stayed in power.

“Although the so-called economists are still talking about interest rates, we will continue to support production and employment. As long as this brother of yours is in this position, the interest will continue to fall with each passing day, each passing week, each month,” he said.

The central bank will hold its next scheduled Monetary Policy Committee (MPC) meeting on Oct. 20.

“Let the investor come and request a loan from our state banks. We will not have them trounced by the rates. Investment does not come with high interest rates,” Erdogan said.

Erdogan is known for opposing higher borrowing costs, which he says only makes “the rich richer and the poor poorer.” He calls high interest rates his “biggest enemy” and the “mother of all evil.”

He believes lower interest rates would lead to lower inflation. Higher rates make it more expensive for households and businesses to borrow money.

Türkiye 'rejects' interest rates-inflation doctrine

The government says inflation will fall with its economic program prioritizing low borrowing costs to boost exports, production and investments, aiming to lower the increase in consumer prices by flipping Türkiye’s chronic current account deficits to a surplus.

Turkiye’s annual inflation topped 83.45% in September, a fresh 24-year high, driven mainly by soaring food and energy prices, which rocketed following Russia’s invasion of Ukraine.

On Friday, Treasury and Finance Minister Nureddin Nebati backed Erdogan’s view and said steps would be taken to bring interest rates down to single digits.

“Turkey’s new economic model refuses belief that policy interest rate should be higher than inflation to curb price increases,” Nebati told private broadcaster CNN Turk. “I think and believe the same way the president does, and I’m determined to carry on,” he said.

“We have been taught one thing; interest should be above inflation. We reject this doctrine. The world does not apply it itself, but it says ‘you should implement it,’” the minister said.

“I believe this new balance will be realized, albeit painfully, and Türkiye will get out of the middle-income trap. The interest rate will go down to single digits, steps will be taken.”

Nebati stressed that the government would not allow citizens to be crushed by soaring consumer prices and said an increase in the minimum wage heading into the new year would be above inflation.

The government has introduced several relief measures to help cushion the blow from rising inflation, including increasing the minimum wage in December and in July, announcing a 25% cap on rent increases and reducing taxes on utility bills. It also has announced a major housing project for low-income families.

“So far, minimum wage earners have not been crushed by inflation, and this year there will be an increase in the same way. The increase in the minimum wage will be above inflation,” Nebati said, Daily Sabah reports.