Uranium is a commodity that trades in niche markets that are often overlooked and under-researched by global investors. This was especially true during its multi-year bear market decline, but that now seems to be changing in a major way.

The U.S. Biden administration has been supporting nuclear in its infrastructure bill and the new Japanese prime Minister Fumio Kishida, is ready to turn the page on the country’s post-Fukushima shutdown of its nuclear power industry. Increasing nuclear reactors from 8 back to 30. Japan is not alone. China and the UK are among the countries looking to push ahead with small modular reactors (SMRs).

“Uranium demand is assured; supply is not” could become the dominant market narrative for next year.

Uranium is nuclear and uranium are always going to be highly polarizing topics for many investors and individuals because of their association with Chernobyl, Fukushima, and, obviously, nuclear warheads. But the reality is that nuclear is a very safe form of energy production. It's one of the cleanest and it's one of the most reliable forms of energy production.

Kazakhstan is the largest uranium-producing country in the world. Financial markets often discount the future and year-to-date, Kazakhstan is the 9th best performing stock market in the world. When Saudi Arabia was an oil country, Kazakhstan is a uranium country.

Kazakhstan as the Saudi Arabia of uranium could become a market narrative in my view.

National Atomic Company Kazatomprom (KAP) is the world’s largest primary uranium producer, commanding an estimated 23% share of global supply with 10.7ktU of attributable production. Tier-1 assets underpin KAP’s status as the world’s second-lowest-cost uranium miner – Kazatomprom London listed shares currently trading around $46 to $48 range with year-to-date +157% return and an estimated P/E of 22.9x and a corresponding dividend yield of 2.93%. current analyst consensus rating stands at 60% buy, 20% hold and 20% sell.

Canada’s Camco uranium producer stock 12m total return stand at 177%. Some Australian uranium mining stock rose +400% to + 500% this year as the markets awake to the new theme of Uranium & climate change amid worsening geopolitical risk

According to the world nuclear Association, Over two-thirds of the world's production of uranium from mines is from Kazakhstan, Canada, and Australia. In 2020 Kazakhstan produced the largest share of uranium from mines (41% of world supply), followed by Australia (13%) and Canada (8%).

As the world re-opens post covid lockdowns and climate change and global warming become ever more important, uranium might play a bigger role in global economies focused on ESG and sustainability as well as in global investment portfolios.

Uranium has been and overlooked & under the research area of the global commodity market.

Uranium is a vital component of the energy needs of the world.

Governments are moving fast to switch to clean energy solutions, but the world's largest economies are still heavily dependent on coal. Many investors have entered the uranium market with keen eyes turned toward its decades-long use cases in nuclear energy as an alternative to coal and natural gas.

Uranium is nuclear and uranium are always going to be highly polarizing topics for many investors and individuals because of their association with Chernobyl, Fukushima, and, obviously, nuclear warheads. But the reality is that nuclear is a very safe form of energy production. It's one of the cleanest and it's one of the most reliable forms of energy production.

And in a world where everyone wants to decarbonize, and move to reduce greenhouse gas emissions, and meet these different climate commitments, uranium and its supply become ever more important.

Rising geopolitical tensions, particularly between the U.S. and China, could lead to a resurgence in the production of nuclear-based weapons and naval vessels. Both countries currently import more than 90% of the uranium they consume. Last year The U.S. Department of Commerce has been investigating whether uranium imports constitute a national security risk.

The uranium market has a relatively small group of mines that produce and then sell to global utilities and suppliers. But unlike other commodities, uranium demand is inelastic.

Fundamental catalysts for the expected price increase in uranium are based on estimates that global demand is expected to rise 44% by 2035, according to World Nuclear Association.

China and India are investing heavily in the nuclear sector in order to reduce carbon emissions. China is widely believed to have 19 nuclear reactors under construction and 41 planned.

In January 2019, India and Uzbekistan signed a deal for the long-term supply of uranium from the resource-rich Central Asian country to power India's domestic atomic reactors. After Kazakhstan, Uzbekistan will become the second country to supply India with uranium.

Often in financial markets, the trend is your friend, and the uranium thematic investment theme could continue to offer the most asymmetric payoff across all other commodities.

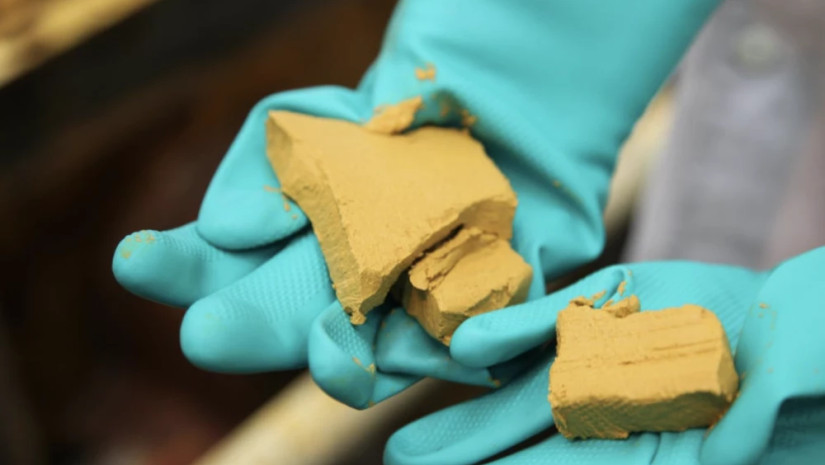

As the supply and demand dynamics in 2022 shift back to the suppliers’ favor as the economic (marginal) cost price could be close to 100% higher than the current spot price, uranium producers could have their (proverbial) yellowcake and eat it, too. Hence, in terms of any investment thesis for 2022, there is perhaps no better commodity than uranium with its bull market finally underway on tightening fundamentals.

Global investors are increasingly realizing that it's critical for nuclear to be part of the low carbon energy mix. And this could be the reason and driver for Uranium to get a lot of investor interest next year and enter a multi-year bull market.

Route to market for investors in uranium can be difficult. But a growing bull market most probably will lead to more investment product innovation.

Rainer Michael Preiss serves as Portfolio Strategist at Golden Equator Wealth Singapore.