As part of Meta’s latest round of job cuts announced in March, the company on Wednesday started laying off employees in technical roles.

Employees with technical backgrounds like user experience, software engineering, graphics programming and other roles announced on LinkedIn that they had been let go by the company on Wednesday morning. A Meta spokesperson confirmed to CNBC the cuts had started.

One employee impacted by the moves told CNBC that Wednesday’s layoffs also hit product-facing teams and that Meta plans to cut business-facing roles, such as finance, legal and HR, beginning in May. The employee, who discussed the layoffs under condition of anonymity to speak freely, said Meta suggested tech teams who weren’t impacted by Wednesday’s cuts may also be included in layoffs next month.

LinkedIn posts indicated that multiple people who worked as gameplay programmers were also affected by the layoffs. Gameplay engineers work on virtual and augmented reality products, according to a Meta job listing.

“I woke up this morning to the unfortunate news that I was one of the many laid-off from Meta today,” a Facebook business program manager wrote on Linkedin.

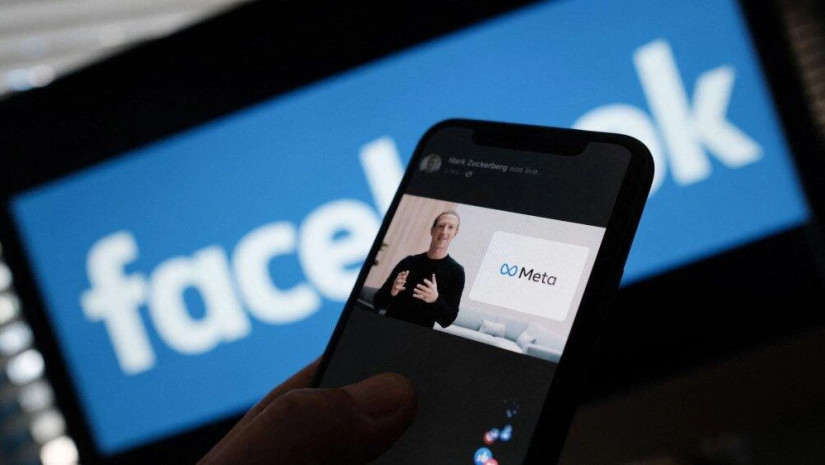

With ad revenue slumping last year and its stock price in free-fall, Facebook’s parent announced its first round of layoffs in November, affecting some 11,000 workers. Meta CEO Mark Zuckerberg then declared 2023 the “year of efficiency,” and proceeded with a plan of an additional 10,000 job cuts in March, resulting in restructuring costs of between $3 billion and $5 billion.

As Zuckerberg said at the time, the new round of April layoffs targets technical workers. He said cuts in the business groups would take place in late May.

Wall Street has applauded the downsizing. Meta shares have soared 81% this year after losing about two-thirds of their value last year. Revenue has declined for three straight quarters, and analysts are projecting another quarterly sales drop when Meta reports its first-quarter earnings next week. The company’s previous guidance called for sales of between $26 billion and $28.5 billion, which means the streak of revenue declines could end if Meta reaches the top end of the range.

While its core business is mired in an online ad slump, Meta is spending billions of dollars a quarter developing technology for the metaverse, representing a huge and risky bet on a nascent market that’s yet to crack the mainstream. Last quarter, Meta’s Reality Labs unit, tasked with building the metaverse, recorded a $4.28 billion operating loss, bringing the unit’s total losses for 2022 to $13.72 billion, CNBC reports.