We are presenting to your attention summary of the results of the Armenian banking sector for 2023, prepared and published exclusively on Banks.am by a specialized consulting company RUMELS Management Solutions.

Ruben Melikyan has more than 23 years’ experience, as a successful c-level executive (CEO/CFO), with a successful track record leading diverse management teams in different areas, like audit, micro-finance, retail, FMCG and banking. Ruben Melikyan is an ACCA member; he graduated from Oxford University (EMBA) and received a Certificate on “Advanced Corporate Valuation” from NYU.

The purpose of this study is to analyze the main financial indicators of the Armenian banking system in 2023.

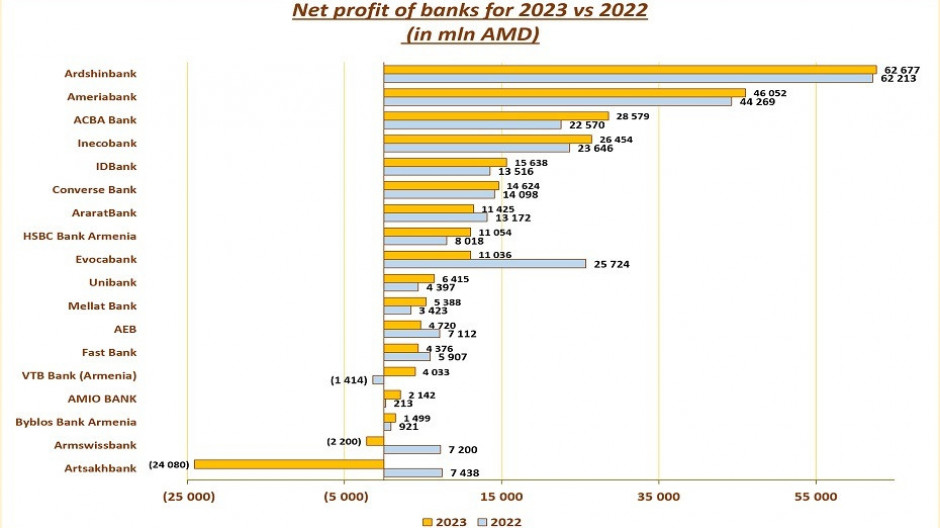

Net Profit

The total net profit of all Armenian banks during 2023 is equal to 230 bln AMD, which is by 32.5 bln AMD, or by 12% less than it was recorded during 2022.

Except for 2 banks, remaining 16 banks registered a profit during mentioned period.

The largest profit was recorded by Ardshinbank, amounting to 63 bln AMD.

Image by: RUMELS Management Solutions

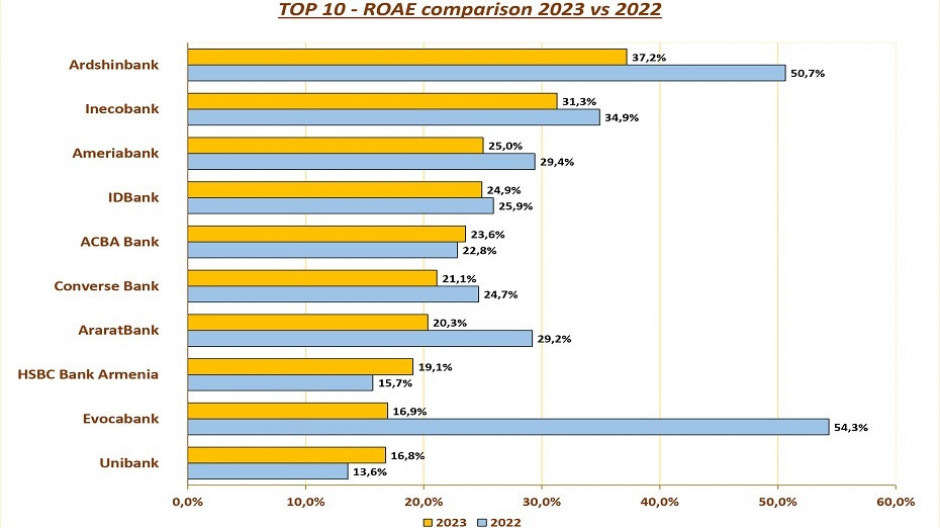

ROE

ROE of banking sector is in 2023 equal to 16.5%.

The highest ROE was recorded by Ardshinbank - 37.2%

Image by: RUMELS Management Solutions

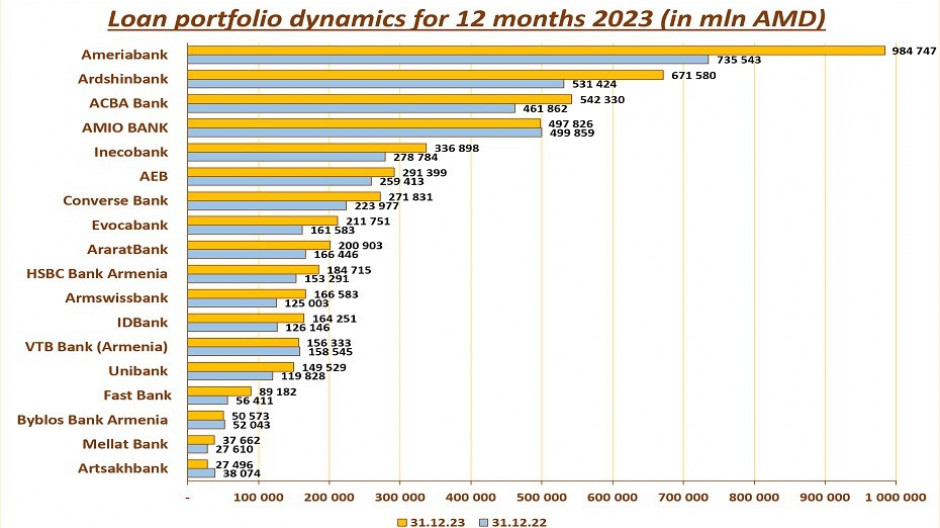

Total loan portfolio

The total loan portfolio of the banking sector during 2023 increased by 21%.

As of 31.12.2023, the total loan portfolio amounted to 5.036 bln AMD and its share in total assets is 55%.

The mentioned total loan portfolio includes retail and corporate loan portfolios.

Image by: RUMELS Management Solutions

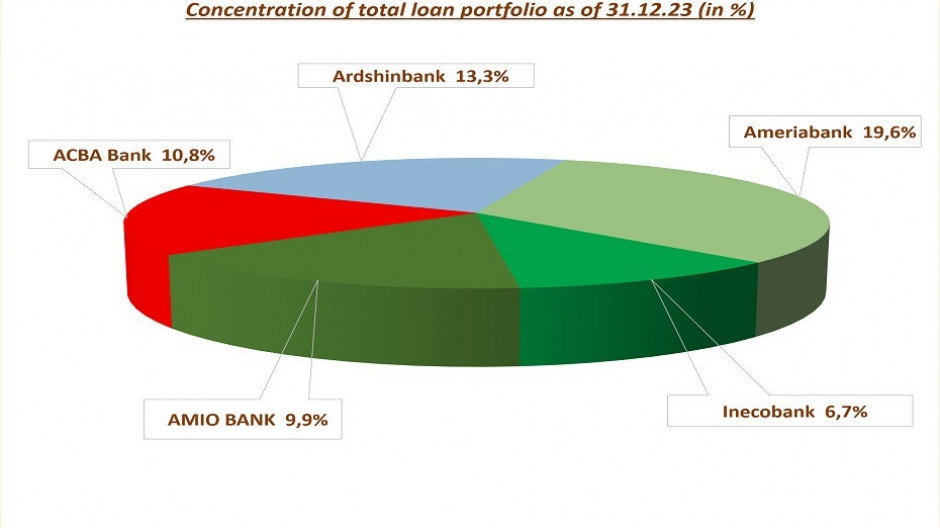

Market share of 5 largest banks (Ameriabank, Ardshinbank, Acba bank, Amio Bank and Inecobank) by total loan portfolio is 60.2%.

Ameriabank has the largest market share – 19.6%.

Image by: RUMELS Management Solutions

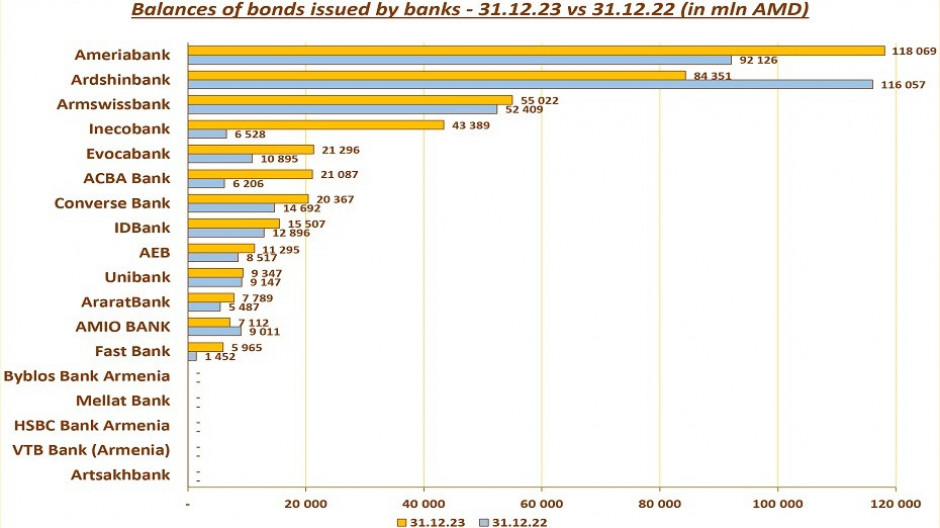

Bonds

During 2023, the total balance of bonds issued by Armenian banks increased by 75 bln AMD, or 22%.

As of 31.12.2023, total balance of issued bonds is amounting to 421 bln AMD.

13 out of 18 banks issued bonds.

Image by: RUMELS Management Solutions

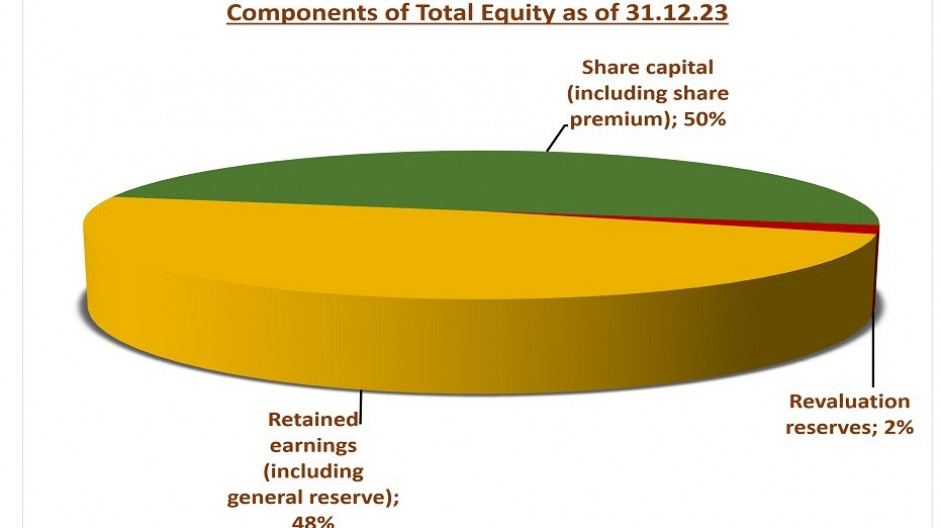

Total Equity

During 2023, the total equity of the Armenian banking sector increased by 174 bln AMD, or 13% and amounted to 1.484 bln AMD.

During 2023, retained earnings (including general reserve) of the Armenian banking sector increased by 145 bln AMD, or by 25% and amounted to 719 bln AMD.

11 banks declared dividends during 2023, amounting to 87 bln AMD.

1. Ameriabank - 23 bln AMD

2. Ardshinbank - 18.1 bln AMD

3. Inecobank - 13 bln AMD

4. IDBank - 7.8 bln AMD

5. HSBC Bank Armenia - 5.8 bln AMD

6. AraratBank - 5 bln AMD

7. Converse Bank- 4.4 bln AMD

8. Acba bank - 4.4 bln AMD

9. Evocabank - 3.44 bln AMD

10. Armeconombank - 1.2 bln AMD

11. Unibank - 0.52 bln AMD

Image by: RUMELS Management Solutions

Full version of the analysis of the Armenian banking sector results for 2023 is available on this link.

Full version of the analysis of the Armenian banking sector results for 9 months 2023 is available on this link.

Full version of the analysis of the Armenian banking sector results for 1HY-2023 is available on this link.

Full version of the analysis of the Armenian banking sector results for 1Q-2023 is available on this link.

Full version of the analysis of the Armenian banking sector results for 2022 is available on this link.