Net profit of Turkish banks reached 65.6 billion Turkish liras ($3.48 billion) in February, nearly double in lira terms compared to last year, the country’s banking watchdog announced on Wednesday.

Total assets of the lenders totaled at 15 trillion liras ($797.5 billion) in February, rising from 9.5 trillion liras ($687.4 billion) in the same month last year, the Banking Regulation and Supervision Agency data showed.

Loans, the largest sub-category of assets, amounted to 8.1 trillion Turkish liras ($427.3 billion) last month.

On the liabilities side, deposits held at lenders in Türkiye – the largest liabilities item – came in at 9.4 trillion Turkish liras ($500.7 billion).

The sector’s regulatory capital-to-risk-weighted-assets ratio – the higher the better – stood at 17.15% at the end of February.

The ratio of non-performing loans to total cash loans – the lower the better – was 1.93%.

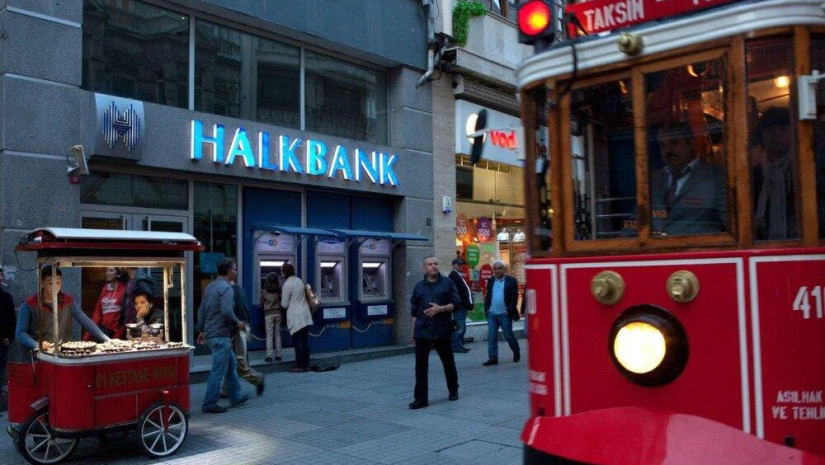

As of end-February, a total of 54 state/private/foreign lenders – including deposit banks, participation banks, and development and investment banks – were operating in Türkiye.

The sector had 209,208 employees working at 1,156 branches both in Türkiye and abroad, along with a total of 48,858 ATMs, AA reports.