Galt&Taggart published a report on Georgia’s Tourism Market Watch for 1Q24. According to the document, in 1Q24, the number of international visitors were up 8.6% y/y to 1.2mn persons. The key drivers behind this growth were arrivals from Turkey, Armenia, Azerbaijan and Israel, while there was a decrease in visitors from Russia and Ukraine among the top 10 contributing countries. From EU countries, arrivals increased strongly from Poland, Germany and Greece in 1Q24.

The number of tourists expected to fully recover in 2024 both in Georgia and globally. Tourist arrivals exceeded 2019 level for the first time in 1Q24 since the pandemic, reaching 106.4% of 1Q19. However, same-day visits are still behind 2019 numbers, because the border with Azerbaijan remains closed. G&T expects tourist arrivals to keep growing and foresee a full recovery of tourist numbers in 2024. But, due to the uncertainty surrounding the reopening of the border with Azerbaijan, same-day visitor numbers might not return to 2019 levels until 2025.

Tourism revenues in 1Q24 were slightly up 1.5% y/y to USD 808mn. This modest growth is explained by last year’s high base. As highlighted in our previous quarterly updates, the faster recovery in tourism revenues compared to arrivals was primarily attributed to rising prices along with GEL appreciation, both of which remained stable in 1Q24.

"We forecast tourism revenues at US$ 4.5bn (+10.0% y/y) for 2024. As previously discussed in our updates, tourism revenues rebounded to 2019 levels already in 2022, attributed to a faster recovery in tourist numbers and the migrant effect along with inflation and GEL appreciation. The strong performance of tourist numbers in 1Q24 suggests a sustained growth in tourism revenues for the full 2024", - the document reads.

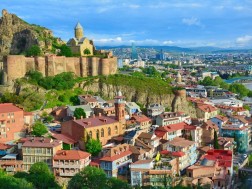

As of the report, hotel room stock maintained its growth trajectory in 1Q24. The total number of hotels increased 0.3% YTD to 1,188 units in 1Q24, while room stock was up 1.6% YTD to 35,875 rooms. The majority of hotel rooms are concentrated in Tbilisi (36.5% of total) and Adjara (30.4%) as of 1Q24.

Hotel occupancy in selected hotels both in Tbilisi and Batumi have recovered to 2019 levels in 4Q23, mostly in November and December. The ADR in selected hotels, both in Tbilisi and the regions is on the rise driven by the increased operating costs and GEL appreciation in 2023.

Airbnb demand declined slightly, with total nights booked in Tbilisi down 3.1% y/y to 120.7k in 1Q24. In contrast, total nights booked in Batumi fell sharply by 30.2% y/y to 42.9k in 1Q24.

Airbnb prices were also down, with quarterly ADR standing at USD 54 (-6.0% y/y) in Tbilisi and at USD 37 (-14.0% y/y) in Batumi in 1Q24.