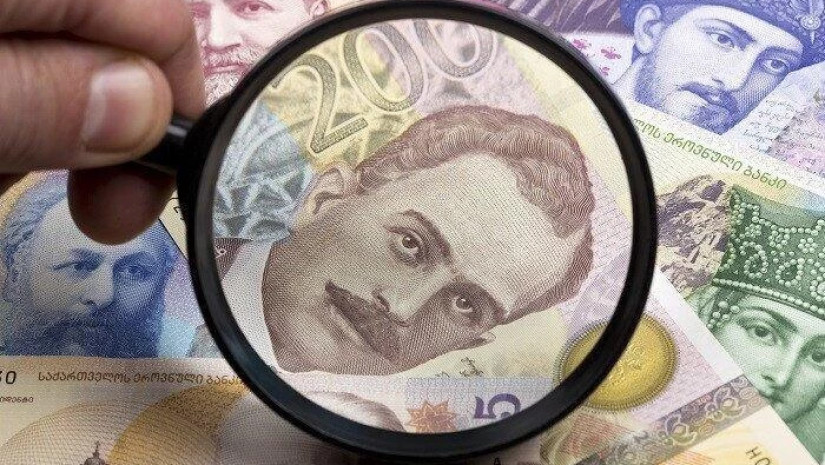

Microfinance organizations increased their loan portfolio by 11.8% or 147.66 million GEL in 1Q2022. The sector earned a net profit of GEL 28.45 million in the first three months of the year. The profit was 24% or 5.45 million more compared to the same period of the last year.

According to the National Bank of Georgia (NBG), the microfinance sector increased its loan portfolio by 11.8% or 147.66 million GEL compared to the same period last year. In January-March, MFOs issued loans of GEL 34.5 million, resulting in a credit portfolio of more than GEL 1.395 billion. MFOs have customers of 737 751 individuals and legal entities.

Private Individuals’ Portfolio - GEL 1.363 billion in 1Q2022.

• Trade and services - GEL 223,844 million

• Consumer loans – GEL 269.733 million

• Agriculture – GEL 124.523 million

• Online loans - GEL 33 472

• Pawnshop - GEL 690.445 million

• Installment - GEL 46.097 million

• Other - GEL 8.14 million

The volume of loans issued to legal entities amounted to GEL 30.898 million.

One financial organization Georgian International MFO has left the market last year and currently 38 microfinance organizations are operating in the market. Their total assets exceed GEL 1.64 billion.